Key areas of focus

- It’s a busy week ahead for macro. January PPI, Consumer Confidence, and Richmond Fed data are due, alongside December home price reports, Durable Goods, and Factory Orders. Earnings season is largely behind us with roughly 85% of the S&P 500 reported, but several notable companies remain, including NVDA on Wednesday night.

- In a 6–3 decision, the U.S. Supreme Court ruled that the Trump administration exceeded its authority when imposing tariffs last year. The decision leaves open whether previously collected tariff revenue must be repaid. Shortly after, the president signed an executive order outlining a 10% global import tax under a provision that limits tariffs to 150 days without congressional approval.

- Crude oil moved sharply higher, up nearly 6% for the week and trading above $66 per barrel marking its highest level in over six months. Prices are now up about 17% year to date, driven largely by escalating tensions between the U.S. and Iran. Rising oil prices matter because they increase input costs across the economy, potentially lifting inflation, and potentially pressuring consumer spending.

Week in review

The data this month has generally been better than feared. The labor market is stabilizing, inflation is moderating, GDP is expanding, and earnings remain solid. At the same time, markets feel cautious. The VIX is above 20, and the S&P 500 is essentially flat year-to-date. This week reflected that push and pull. Markets were closed on Monday for Presidents’ Day. Tuesday was mixed, with strength in New York manufacturing activity but weaker builder confidence due to affordability concerns. Wednesday delivered better-than-expected housing starts and durable goods orders, while the FOMC minutes showed a divided Fed, with some members open to cuts and others comfortable holding steady. By Thursday, geopolitics lifted oil and gold, offsetting jobless claims that came in below consensus and a strong Philly Fed survey. Friday closed firmer for equities. GDP came in softer than expected, partly reflecting a federal spending drag tied to the government shutdown. Personal spending was slightly above expectations, while core PCE ran higher. The Supreme Court also struck down the Trump administration’s tariffs imposed under the International Emergency Economic Powers Act (IEEPA).

Spotlight

Japanese equities have quietly put together a strong run to start the year, with the MSCI Japan Index up 12.82% through Friday’s close. The backdrop has been supportive. Under a Takaichi-led government, investors are factoring in moderating inflation, stable monetary policy, and potential incremental fiscal stimulus. Leading up to the snap election, as the probability of a Takaichi win increased, long-end yields moved higher and the Yen weakened. This is consistent with the inflationary backdrop implied by greater fiscal stimulus and constrained monetary policy. More recently, the tone has shifted. The yield curve has flattened, inflation expectations remain contained, and the Yen has strengthened as markets price a higher likelihood of exiting the ultra-low real rate regime. From a portfolio allocation standpoint, Japan matters. It is the second-largest country weight in the MSCI ACWI at 5.03%, behind the U.S. at 62.96% and ahead of the U.K. at 3.34%. Not including the U.S. in the index, Japan becomes the largest weight at 13.57%, ahead of the U.K. (9.02%) and China (8.34%).

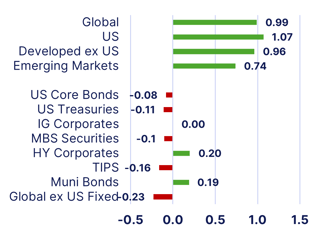

Markets

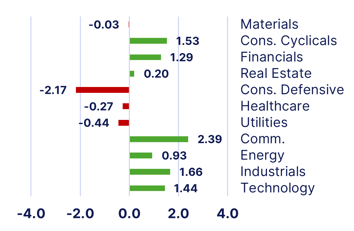

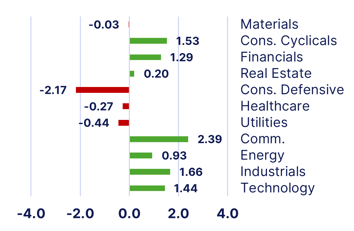

Sectors

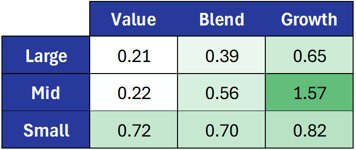

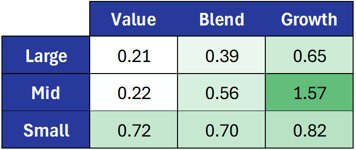

Style & Market Cap

Sources

1. Empire State Manufacturing Survey

The Federal Reserve Bank of New York, Empire State Manufacturing Survey, retrieved from New York Fed, https://www.newyorkfed.org/survey/empire/empiresurvey_overview

2. Housing Starts & Building Permits

United States Census Bureau, Monthly New Residential Construction, retrieved from U.S. Census, https://www.census.gov/construction/nrc/current/index.html

3. Durable Goods Orders

United States Census Bureau, Monthly Advance Report on Durable Goods Manufacturers' Shipments Inventories and Orders, retrieved from U.S. Census, https://www.census.gov/manufacturing/m3/adv/current/index.html

4. Jobless Claims

U.S. Department of Labor, Unemployment Insurance Weekly Claims, retrieved from U.S. Department of Labor; https://www.dol.gov/ui/data.pdf

5. Philly Manufacturing Survey

The Federal Reserve Bank of Philadelphia, Manufacturing Business Outlook Survey, retrieved from Philadelphia Fed, https://www.philadelphiafed.org/surveys-and-data/regional-economic-analysis/manufacturing-business-outlook-survey

6. 4th Quarter GDP

Bureau of Economic Analysis, Gross Domestic Product, 4th Quarter 2025 (Advance Estimate), retrieved from BEA, https://www.bea.gov/news/2026/gdp-advance-estimate-4th-quarter-and-year-2025

7. Personal Consumption Expenditures Price Index (PCE)

Bureau of Economic Analysis, Personal Consumption Expenditures Price Index, retrieved from BEA, https://www.bea.gov/data/personal-consumption-expenditures-price-index

8. Home Builder Sentiment

National Association of Home Builders (NAHB), Builder Sentiment Edges Lower on Affordability Concerns, retrieved from NAHB, https://www.nahb.org/news-and-economics/press-releases/2026/02/builder-sentiment-edges-lower-on-affordability-concerns

9. The Fed’s January Meeting Minutes

The Federal Reserve Board, Minutes of the Federal Open Market Committee, January 27-28, 2025, retrieved from Board of Governors of the Federal Reserve System; https://www.federalreserve.gov/monetarypolicy/fomcminutes20260128.htm

Market Data

Morningstar Direct using Morningstar Indices

Authors:

Anthony Silva, CFA®

Senior Director of Strategy Management

World Investment Advisors, LLC