- Home

- Insights

- Wealth Management Resources

Categories:

Market Bulletin: 'Tis the Season for Rate Cuts

Categories:

The Fed Cuts Rates by 0.25% at December 2025 Meeting

Key Takeaways

Why did the Fed cut rates this week?

The Fed prioritized labor market weakness over persistent inflation above its 2% target, as it remains worried about the cooling of the labor market in recent months.

What is the Fed’s outlook for the U.S. economy?

The Fed is still expecting inflation to fall toward its 2% target over the next several years, and it now expects higher real GDP growth in 2026 and 2027. However, Chairman Jerome Powell estimated that payroll growth is currently being overstated and was likely negative from May to September. This paved the way for their rate cut this week.

What is the Fed’s stance going forward?

The Fed described its policy as neutral, but we view the cut as accommodating for increasing economic activity and bracing the labor market. Although Fed policy is not on a preset course and will remain data-dependent, Chairman Powell indicated that rate hikes are not likely soon.

How might this rate cut impact the economy?

This rate cut may help boost consumer spending in the economy by lowering the cost of some consumer debt, such as credit card rates tied to the prime rate. Long-term rates (especially the 10-year Treasury rate) need to fall to make a dent in the rates many corporate and consumer borrowers pay. The Fed has a more limited impact on those rates through its fed funds rate policy.

How did markets react to this rate cut?

Markets were pricing in a rate cut, but equities jumped on the news that rate hikes at subsequent meetings are off the table (for now). Bonds closed mostly unchanged. Markets are currently pricing in a pause on rate cuts at the next Fed meeting in January 2026, and then a 0.25% rate cut in both March 2026 and July 2026 to bring rates to 3-3.25%.

Details on the Fed’s decision and Powell’s comments follow.

What Happened?

The Policy Decisions

The Federal Reserve Open Market Committee (FOMC) cut the federal funds rate by 0.25%, bringing it to 3.50-3.75%. This is the third consecutive 0.25% cut since September and brings the rate to its lowest level since the November 2022 meeting, and well below the most recent peak of 5.25-5.50% that lasted from July 2023 through September 2024. The decision drew three dissents—two favoring no change and one preferring a larger cut.

Separately, the Fed directed the New York Fed’s Desk to conduct reserve management purchases of shorter-term Treasury securities (primarily Treasury bills), starting with about $40 billion beginning December 12. These operations are intended solely to maintain an ample level of reserves and support effective control of the policy rate. The Fed was explicit that this should not be interpreted as a new round of quantitative easing. The Fed also removed the aggregate limit on standing repo operations to help ensure smooth policy implementation.

With the policy decisions today, the Fed has signaled again that its concerns about the labor market outweigh its worries about inflation, and it is taking steps to stimulate the economy in support of the labor market.

Market Implications

Equity markets rallied following the Fed’s announcement, as investors welcomed confirmation that future rate hikes are off the table and policy is now in a neutral range. Major indices posted gains on expectations of continued monetary support and improving growth prospects for 2026.

Bond markets were more muted: Treasury yields held steady, reflecting that the cut was widely anticipated and long-term rates remain anchored by growth expectations rather than inflation fears.

Per CME Group’s FedWatch on December 10, 2025, markets are expecting a pause on rate cuts at the next Fed meeting in January 2026, and then a 0.25% rate cut in both March 2026 and July 2026 to bring rates to 3-3.25%.1

Updated Economic Expectations

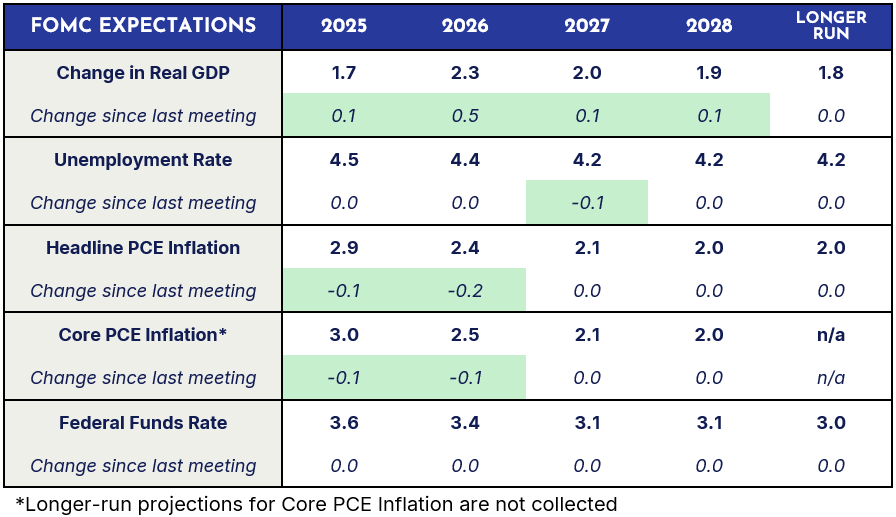

The Fed adjusted its expectations for economic growth higher and its expectations for inflation lower in the coming years. These rosier economic expectations for the future paved the way for the FOMC to cut rates at the December 2025 meeting. During his press conference, Powell noted that the strong consumer spending and productivity gains the U.S. economy has experienced have contributed to this improved outlook, but he declined to attribute those gains solely to the advancement of artificial intelligence in recent years.

Dual Mandate Challenges

Fed Chair Jerome Powell emphasized that the Fed is managing a challenging trade‑off in pursuit of its dual mandate of price stability and full employment. Although the economy continues to expand at a moderate pace, risks to inflation are tilted to the upside and risks to employment are increasingly to the downside, presenting the Fed with no risk-free path for policy. The Fed will continue to monitor economic data and maintain flexibility in its policy choices to manage its policy risks.

Why?

Labor Markets

As we expected in late 2024, the Fed has remained laser-focused on the U.S. labor market during 2025, and we expect that to continue throughout 2026. The Fed is no longer describing the unemployment rate as “low” in its official statement.

Powell described a gradual “cooling” of the labor market that accelerated in recent months. The Fed continues to observe both a decline in the demand and supply of labor, as businesses post fewer jobs and unemployed workers seek fewer of them.

Powell added that job creation has been negative and that payroll growth is currently being overstated by approximately 60k jobs per month. This would imply that the roughly 40k payroll growth reported from May to September is actually closer to -20k per month. Powell stated that “a world where job creation is negative” is a situation the FOMC needs to watch “very carefully.”2

Inflation

Powell acknowledged that inflation remains above target. Powell noted that inflation of the prices of services has decreased, but those declines have been more than offset by increases of inflation in the prices of goods. According to the Fed’s analysis, at least half of the excess inflation seen in the price of goods recently has been caused by tariffs. The Fed expects the inflation impact of tariffs to be temporary as the mostly one-time effects of tariffs work their way into prices.

What Happens Next?

Future Path of Short-Term Rates

Going forward, Powell stated during his post-announcement press conference that future rate hikes are not the base case in 2026, and most FOMC members expect to keep rates at this level or cut one more time.

As for the timing of future rate cuts, the market and the FOMC have diverging views. CME Group’s FedWatch is expecting a couple of cuts in 2026, while the FOMC’s projection expects only one.

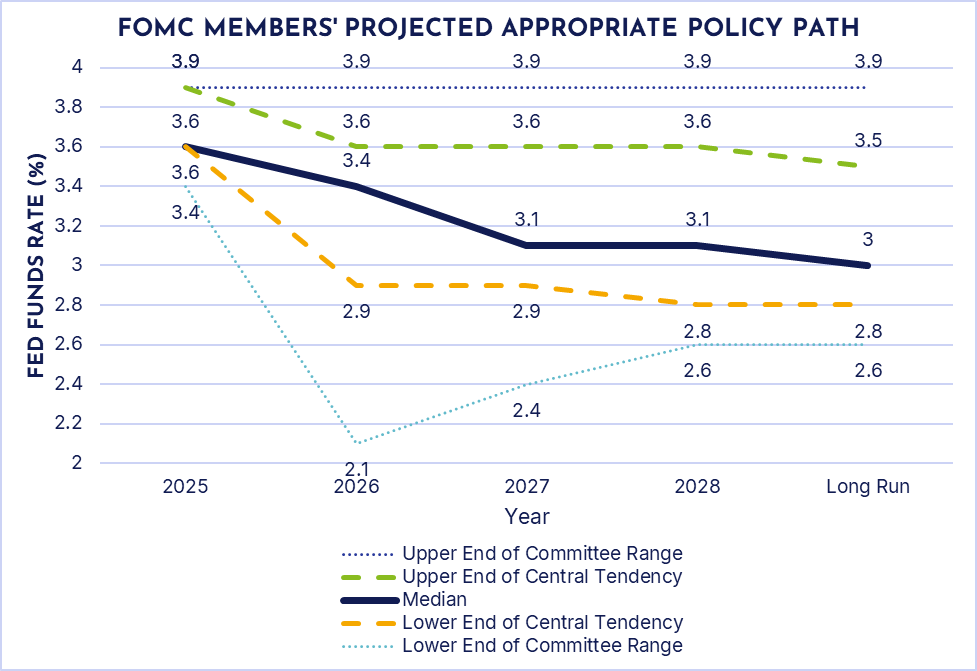

The FOMC members updated projections for future rates continue to show a path that slowly falls to 3% after 2028. However, there is a wide dispersion among some FOMC members about the appropriate rate level in 2026 and 2027, with the difference between the highest and lowest appropriate rate projections being 1.8% in 2026 and 1.5% in 2027.3

Note: The Fed’s central tendency removes the three highest and three lowest projections from each year.

Uncertainty about Long-Term Rates

When asked about the increase in long-term rates since the Fed began cutting in September 2024, Powell suggested that the increase may be due to higher expectations for economic growth rather than higher expectations for inflation. As evidence, he noted that 10-year inflation breakevens (i.e., the difference in yield between the 10-year US Treasury and 10-year US Treasury Inflation Protected Security) have remained fairly steady during that time between (note: 10-year breakevens have average 2.32% from 9/17/2024 through 12/9/2025).

Housing and Affordability

Powell noted that while consumer spending remains strong in certain segments of the population, housing has been weak. Similar to what we argued in our recent Quarterly Market Series in October 2025, Powell was explicit in his comments that rate cuts will not make housing more affordable. Not enough housing is being built in certain areas in the United States, leading to housing shortages in those markets, and the Fed has no tools to address the secular housing shortage.

Powell also commented that most of the (un)affordability issues people feel today stem from increases in inflation during 2022 and 2023 that remain embedded in prices today. Powell stressed that the United States needs to have strong economic growth and productivity gains to drive real wage growth for workers to feel better about affordability, and Fed policy will help facilitate that.

The WIA Investment Team will continue to monitor markets and the economy and provide you with updates and analysis. Please contact your advisor or info@worldadvisors.com with any questions, comments, or requests.

Sources

Nate Garrison

CFA®,CAIA,CIPM,FRM

Senior Vice President/Chief Investment Officer