We will act as a fiduciary as it relates to the investment services provided to your plan, which means we commit to providing guidance and advice solely in the best interest of plan participants and beneficiaries. Leverage our 3(21) service co-fiduciary liability model, or offload many of those responsibilities to help mitigate your risk by engaging us through our 3(38) service model.

Fiduciary Investment Services

- Home

- How We Help

- Manage Retirement Plans for Your Employees

- Fiduciary Investment Services

Support for your retirement plan investments with World Investment Advisors

You can benefit from extensive investment expertise, infrastructure, support team, systems, and compliance processes. We want to free up your time to focus on areas where you can make the most impact, such as plan optimization and participant engagement.

75%

13%

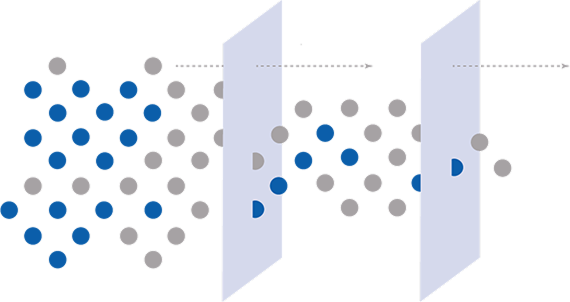

Represents Plan Sponsor Engagement in Investment Monitoring & Selection

WHAT OUR QUALITATIVE

ANALYSIS INCLUDES

Our processes go beyond typical performance metrics to serve diverse demographics and objectives. We blend proprietary qualitative and quantitative analysis with behavioral economics to establish and monitor our clients' most suitable investment solutions.

We go beyond performance with a focus on enhancing employee experience and outcomes, because a good investment is not always the right investment.

PROPRIETARY INVESTMENT REPORTING AND ANALYSIS

PERSONALIZED PORTFOLIOS

FOR EMPLOYEES

In partnership with Morningstar®, our Managed Account Program offers customized retirement strategies for each participant. You can provide employees with access to personalized, professionally managed portfolios designed to help them stay on track to meet their goals.

Available only on select record-keeping platforms. Please reach out to sales@worldadvisors.com for more information.

-

Personalized

We tailor our strategies to each individual’s situation.

-

Comprehensive

We do the work; your employees have confidence they’ll meet their goals.

-

Simplified

We look beyond retirement assets to help build a more complete strategy for future income needs.

-

Ongoing

We constantly review and adjust allocations as conditions or circumstances change.