- Home

- Insights

- Employer and Retirement Plan Sponsor

Categories:

Plan Sponsor Guide: Governance And Documentation

Categories:

The decision to offer a retirement plan is impactful and provides many benefits both to you as a plan sponsor and to your employees as participants in the plan.

For example, offering a retirement plan allows you the opportunity to take advantage of tax credits and to motivate employees – both prospective employees and current employees.

Because a relatively few number of decision-makers can impact the retirement savings of hundreds or even thousands of employees, the Employee Retirement Income Security Act, as amended (ERISA) requires that the decisions you make affecting the management and administration of the retirement plan be made prudently and solely in the interest of the plan’s participants.

ERISA requires expertise in a variety of areas including, selection and monitoring of investments; administration; and selection and monitoring of service providers. Fortunately, under ERISA, when you lack this expertise, you may hire (and should hire) professional assistance. Thus, you are not left to go it alone.

This Guide will assist you in understanding your fiduciary obligations and properly allocating and/or delegating responsibilities through a plan committee and across the plan’s service providers. It will also, in combination with the additional materials in the G-MAP Training Series, provide a consistent and repeatable framework for managing and documenting your ongoing fiduciary duties.

The Plan’s Fiduciaries

All plans are required to have at least one fiduciary (a person or entity) named in the written plan, or through a process described in the plan, as having control over the plan’s operation. The “named fiduciary” can be identified by office or by name.

A plan administrator is also a fiduciary under ERISA and may be the same person(s) named in the plan document. If the plan document doesn’t designate a plan administrator, then the plan sponsor will be the plan administrator. Unless otherwise delegated, the plan administrator has day-to-day responsibility for plan operations.

In many cases, the company’s board of directors or business owner(s) may be the named fiduciary in the plan document, but plan administration is delegated to another person or a plan committee. At the end of the day, anyone who exercises discretion over the management or administration of the plan will be considered a fiduciary, regardless of his/her title.1 The table below provides examples of activities that would typically give rise to fiduciary status under ERISA.

1 https://www.law.cornell.edu/cfr/text/29/2509.75-8

“This Guide will assist you in understanding your fiduciary obligations and properly allocating and/or delegating responsibilities through a plan committee and across the plan’s service providers.

While the plan administrator or committee may enlist the support of third-parties to assist with any of the above-referenced activities, the plan fiduciaries remain responsible for ensuring that all requirements are met. Even if a service provider contractually agrees to exercise discretion over certain activities (e.g., an investment manager may arrange to select and replace investments without advance approval), the plan fiduciaries remain responsible to prudently select and monitor the service provider to ensure it is performing the services in accordance with the terms and conditions of the contract (i.e., periodically checking the investment manager’s qualifications and evaluating whether it is following the plan’s investment policies).2

Attorneys, accountants, and actuaries generally are not fiduciaries when acting solely in their professional capacities. Similarly, a third party administrator, recordkeeper

or anyone who performs solely ministerial tasks is not a fiduciary; however, that may change if he or she exercises discretion in making decisions affecting management or administration of the plan or has discretionary control over the plan’s investments.

Anyone who exercises discretion over the management or administration of the plan will be considered a fiduciary, regardless of his/her title.

Fiduciary Responsibilities Under Erisa

A fiduciary is a person who owes a duty of care and trust to another and must act primarily for the benefit of the other in a particular activity. ERISA imposes specific standards of care on retirement plan fiduciaries and prohibits certain transactions between the plan and its fiduciaries or other “disqualified persons.”3 Significant penalties can be levied against fiduciaries who breach their duties under ERISA, including personal liability or even criminal sanctions.

A fiduciary’s responsibilities include:

- Acting solely in the interest of the participants and their beneficiaries;

- Acting for the exclusive purpose of providing benefits to workers participating in the plan and their beneficiaries, and defraying reasonable expenses of the plan;

- Carrying out duties with the care, skill, prudence and diligence of a prudent person familiar with the matters;

- Following the plan documents; and

- Diversifying plan investments.

The duty to act prudently requires fiduciaries to consider relevant information (or that which they should know to be relevant) in order to make well-informed decisions. When you lack the requisite expertise to do so, ERISA requires you to hire professional assistance. Because prudence is all about “process,” you should document the steps you took and the basis for all of your decisions, including a decision to hire a service provider for help with meeting your fiduciary duties.

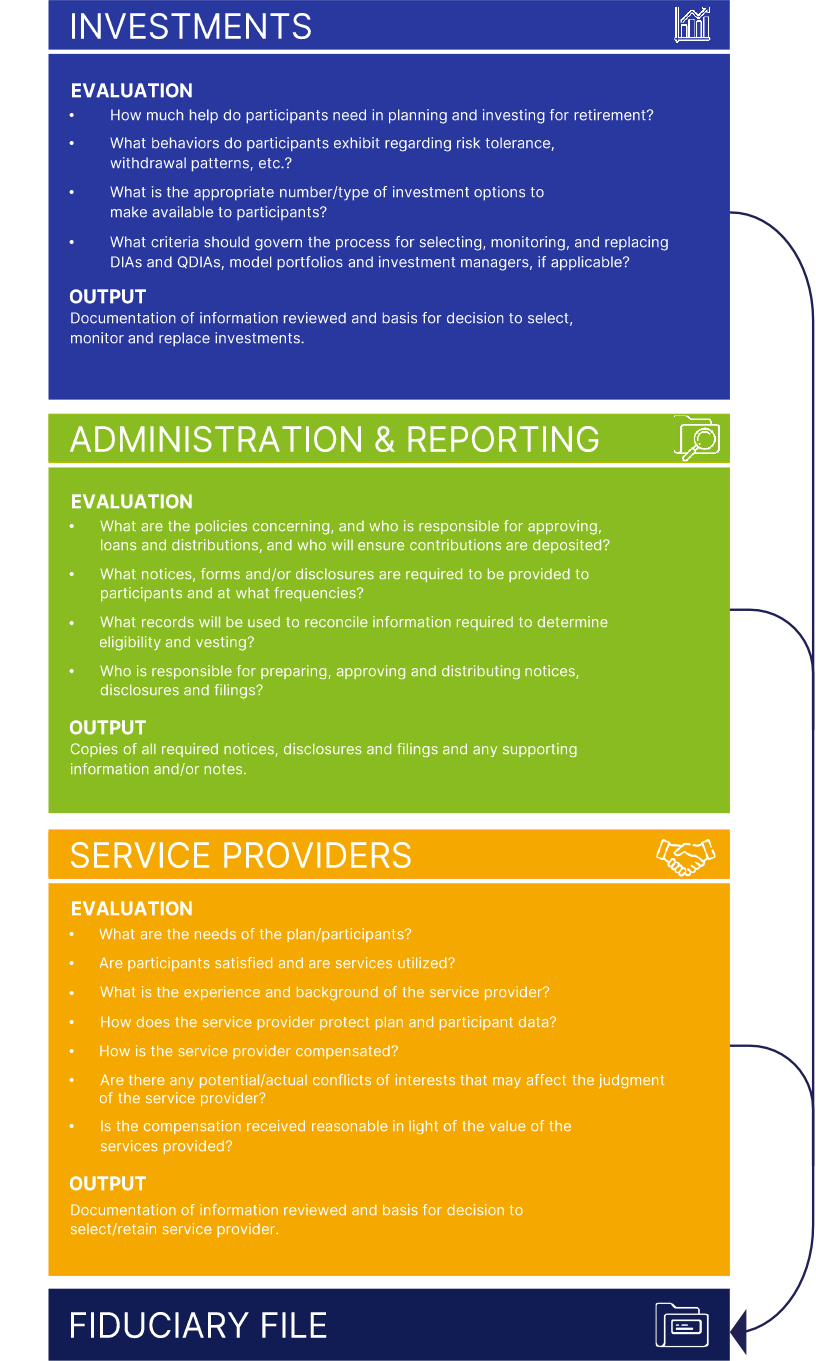

There are three primary areas of fiduciary responsibility for a typical participant- directed retirement plan: (1) selection, monitoring and replacement of the plan’s service providers; (2) selection, monitoring and replacement of diversified investment; and (3) approval, distribution and filing of required notices and reports (e.g., Form 5500, participant disclosures, etc.). A sample process for each of these three areas may begin with asking questions and documenting results and outcomes, as shown on the following chart.

3 http://www.irs.gov/Retirement-Plans/Retirement-Plan-Investments-FAQs

Because prudence is all about process, you should document the steps you took and the basis for all of your decisions.

The Plan Committee

Given the nature and scope of duties imposed upon plan fiduciaries, many plan sponsors find it helpful to work through a committee. While the committee may act as a whole and share fiduciary liability under ERISA, the plan may also establish clearly defined responsibilities and allocate liabilities accordingly. There are essentially three areas of plan operations that implicate fiduciary functions:

- Selection and monitoring of service providers;

- Selection and monitoring of investments; and

- Administration, reporting and disclosures.

One way to ensure plan fiduciaries fulfill their duties is to adopt a structure that assigns each of the above-referenced functions to a separate decision-maker.

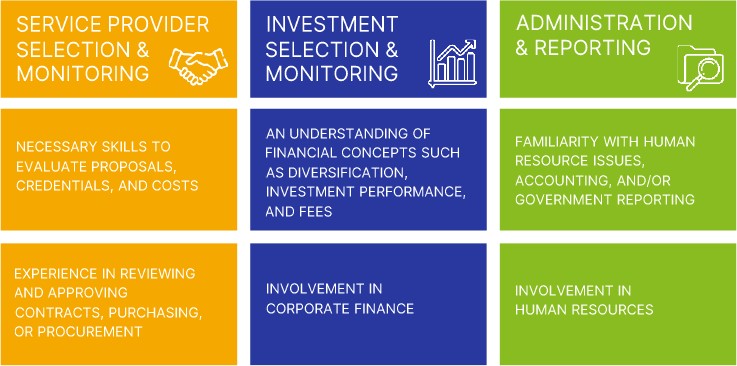

Committee structure is a decision that should be carefully made, and plan sponsors should assign responsibilities to individuals who are well-suited to perform each required function. Each committee member should also be made aware of his/her fiduciary responsibilities and liabilities. The table below highlights the skills necessary to serve on a committee.

Committee Charter

Utilization of a committee charter is one way to allocate responsibilities and liabilities

among committee members and to ensure that committee members understand their respective roles. The committee charter may include relevant criteria to support fiduciary decisions relating to the management and administration of the plan, including an explanation of the structure of the committee and the status of committee members.

It is important to keep in mind that not everyone serving on the plan committee has to be a fiduciary under ERISA; it may be helpful to enlist the support of employees with particular skills to help the fiduciaries gather and evaluate information. If a committee member does not have the authority to vote on final decisions, he/she will not be a fiduciary. Non-voting committee members can help streamline the decision- making and documentation process and are particularly valuable in small plans where the fiduciaries may lack the time or experience to understand all of the relevant aspects necessary to make well-informed decisions.

The charter may also provide guidance regarding the appointment of committee members and policies and procedures relating to the way in which the committee will be run, including voting procedures. Should the plan fiduciaries decide to adopt a committee charter, they may do so by having each member sign the charter. It may also be advisable to adopt a board/corporate resolution in order to confirm adoption of the committee charter.

If a committee member does not have the authority to vote on final decisions, he/ she will not be a fiduciary. Non-voting committee members can help streamline the decision- making and documentation process.

Document Retention

Under ERISA, both the Department of Labor (DOL) and the Internal Revenue Service (IRS) have jurisdiction over retirement plans. The DOL is charged with overseeing the rules imposed upon plan fiduciaries under ERISA. The IRS has responsibility for determining qualified status and examining plans. Given the complexity of the rules and increased scrutiny by government regulators, it is important for plan fiduciaries to ensure they are working with a knowledgeable consultant who understands the requirements and has the expertise to help prepare for the possibility of a plan audit or investigation.

DOL Investigations

In order to effectively become “audit ready,” plan fiduciaries need to understand the

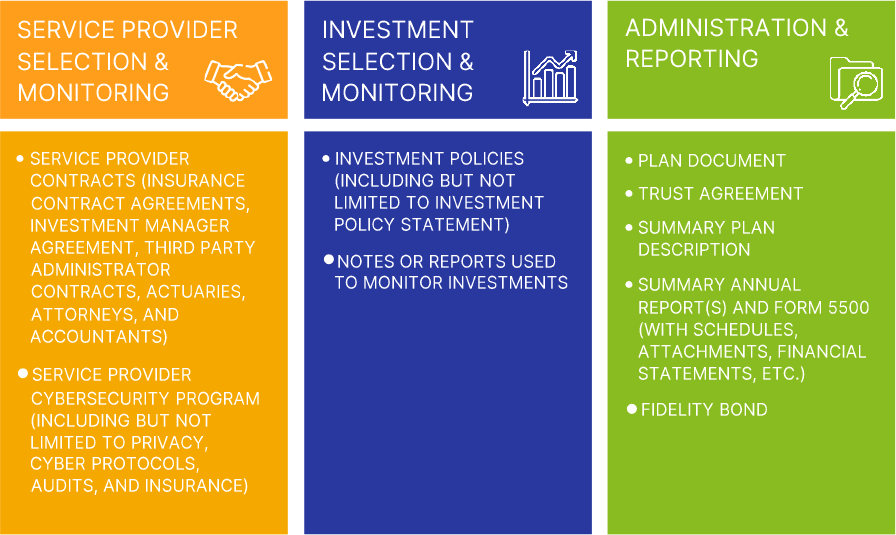

process. Most DOL audits begin with a letter advising the sponsor of the audit and requesting applicable plan documents and information about the company. Although document requests vary, there are several standard document requests that are the same across all initial DOL requests, including but not limited to:

Establishing prudent processes designed to proactively capture the documents required to demonstrate compliance with applicable laws and regulations will eliminate the time and expense associated with an eventual audit or investigation. These processes will also help plan fiduciaries detect and prevent violations.

For a more comprehensive list of requested items in DOL requests, see PRI’s Sample DOL Document Request.

What To Keep And For How Long?

Documentation is critical for demonstrating that fiduciaries follow prudent practices in the management and administration of the plan and plan assets. Certain plan records, such as every version of the plan document, should never be discarded.

Similarly, individual participant records should be maintained so that fiduciaries can properly respond to and resolve any inquiries made by plan participants.

The Form 5500, for example, has a statute of limitations which begins when the form is filed and runs for three years from that date. Any documents contemplated by or used in preparation of Form 5500 must, therefore, be held for at least three years beyond the date of filing. With respect to all other ERISA-related documents, those documents that pertain to agency filings or to participant or beneficiary statements should be maintained for not less than six years after the filing date (or six years after the date on which such documents would have been filed but for an exemption or simplified reporting requirement). In addition, those records sufficient to determine benefits due or benefits that may become due must be kept until no longer relevant.

DOL issued guidance on Cybersecurity for the first time in April 2021. We expect that this is an area where they will place more emphasis when investigating benefit plans.

For more information on DOL’s guidance, please see the press release from April 2021.

G-MAP: Model Administrative Procedures For Plan Governance

Maintaining adequate security of plan information, particularly participant data, is an important fiduciary responsibility. Although the Department of Labor (“DOL”) has not published specific guidelines for plan fiduciaries regarding participant identity/plan information security (“information security”) related to benefit plans, it is reasonable to believe the DOL would expect confidential plan and participant data to be maintained securely. Additionally, given the fiduciary duty of prudence, plan sponsors are encouraged to develop, implement and document a policy for information security. The policy, which should include training for employees who will be handling plan and participant information, should be reviewed regularly and updated as necessary.

Monitor & Document

Fiduciaries have an ongoing duty to monitor, among other things, the following:

- Fiduciaries and committee members are educated and understand their roles and responsibilities;

- The plan is administered and operated in accordance with the Plan Document;

- Services provided to the plan are necessary;

- Expenses are properly paid from plan assets and CSP disclosures are current;

- CSPs are delivering services in accordance with the terms of their arrangements, and fees paid to CSPs continue to be reasonable in light of the value received;

- All notices and required disclosures/ reports are timely and accurately delivered;

- Compliance documentation is retained and current;

- Investments are selected, monitored and replaced in accordance with the plan’s IPS; and

- Participants receive sufficient information from which to direct the investment of their individual accounts